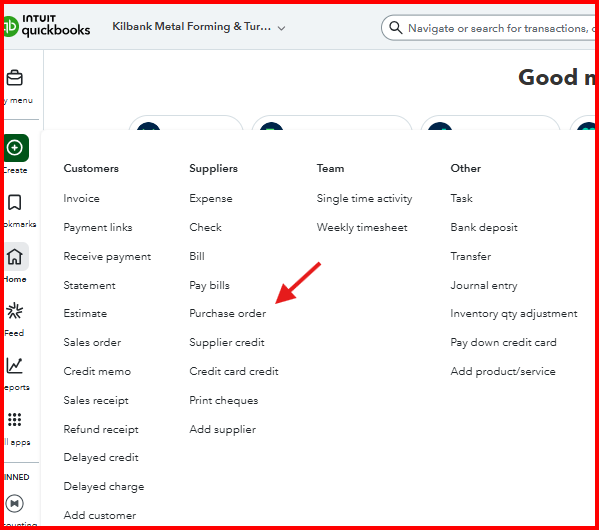

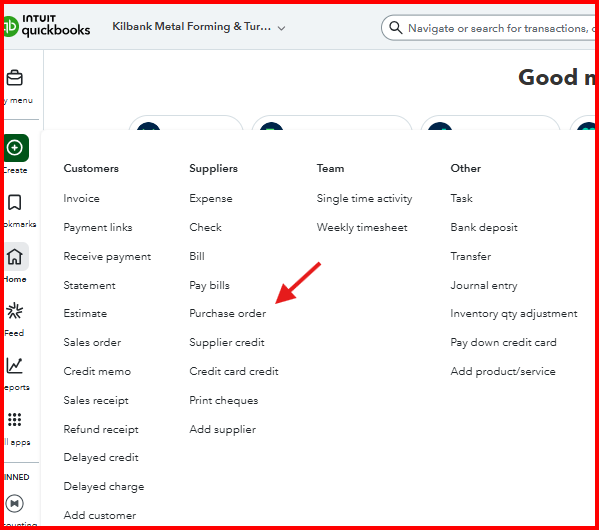

Learn how to create purchase orders and send them to vendors. In QuickBooks Online, you have the too...

Discover tax tips for small business owners and self-employed individuals in Canada. From claiming expenses to understanding tax residency, find valuable insights to optimize your business finances.

Learn how to create purchase orders and send them to vendors. In QuickBooks Online, you have the too...

.png)

How to Maximize Your Donation Tax Credit in Canada Giving back to your community not only supports i...

.png)

When Do They Qualify as a Medical Expense? If you or a family member require assistance with daily l...

.png)

When Do They Qualify as a Medical Expense? Many Canadians pay for private health and dental insuranc...

.png)

What They Are, How They’re Calculated, and Why They’re Different If you invested in a limited partne...

.png)

How They Work and How They Can Reduce Your Taxes In Canadian tax planning, one of the most powerful ...

.png)

🔹 What Is a Capital Loss? A capital loss occurs when you sell a capital asset for less than its adj...

.png)

How It Works and How It Can Reduce Your Taxes Investing in small businesses can offer significant op...

.png)

How to Claim Moving Costs on Your T1 Return Did you move this year for work, business, or school? Yo...

-2.png)

What Parents Need to Know for Tax Season If you’re a working parent in Canada, child care can be one...