Paying your payroll source deductions (CPP, EI, and income tax withheld) on time is one of the most...

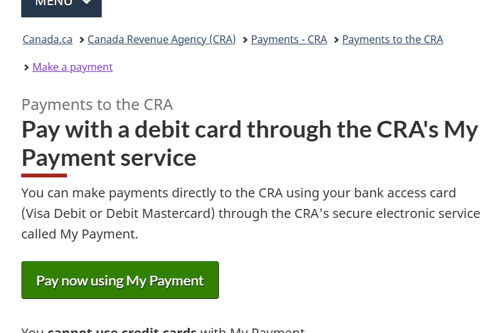

How to Pay Your HST Remittance Online with the CRA “My Payment” Service

If you’re a business required to remit HST, knowing your payment options is key. One convenient method is the CRA’s “My Payment” service, which lets you pay online using a Canadian bank access card. Below is a step-by-step guide to walk you through the process, and some tips to avoid common mistakes.

Why use My Payment for HST?

The “My Payment” service offers these benefits:

-

It is secure and online — no cheque-mailing required.

-

It supports HST remittances for businesses.

-

Payments are usually considered received on the same business day (depending on your bank and cut-off time) when using online services.

What you’ll need before you start

Before heading to the payment screen, gather the following:

-

Your business’ CRA Business Number (BN) including the GST/HST program account (e.g., 123456789 RT0001).

-

The amount owing (from your GST/HST return or statement).

-

A debit card with one of the accepted logos (Visa Debit or Debit Mastercard) from a participating Canadian bank or credit union.

-

A computer or device with a secure, up-to-date browser and reliable internet connection (security is important).

Step-by-step: Paying HST via My Payment

Here’s the process you can follow:

-

Go to the CRA’s My Payment page

Visit the official page on Canada.ca for “Make a payment – Payments to the CRA” or in https://www.canada.ca/en/revenue-agency/services/payments/payments-cra/individual-payments/make-payment.html -

Choose the My Payment option

On the payments page, under “One-time payment using CRA online services”, select the Using My Payment link. My Payment is the service that lets you pay with your bank access card. You can then click on Pay now using My Payment

-

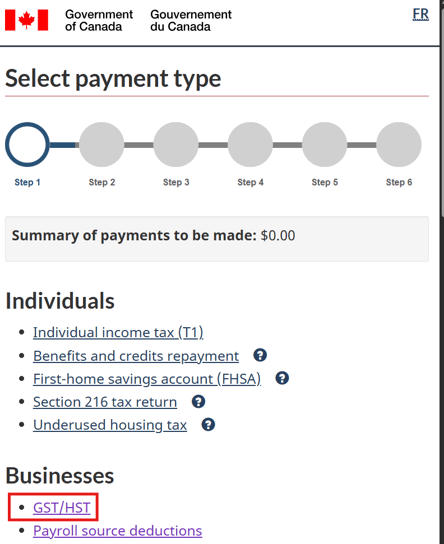

Select your payment type

Since you are remitting HST, select the appropriate business payment type (in this case, “GST/HST")

-

Select payment allocation

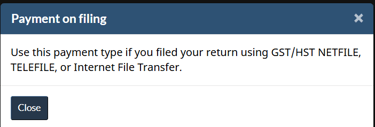

Select one of the options from: Payment on filing, interim, Amount owing, or Balance Due You can click on the ? on each option to see a description.

You can click on the ? on each option to see a description. -

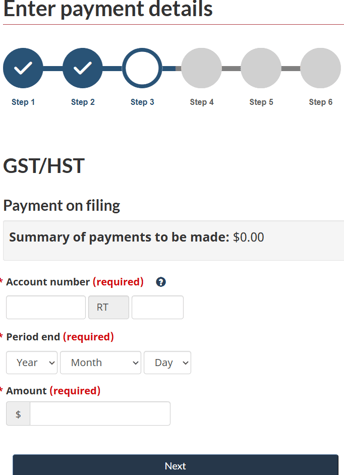

Enter your business information

Input your Business Number, the specific program account (ex: 123456789 RT 0001) and the amount owing. Double-check the digits to avoid misallocation.

Enter the Period End that the payment is being applied to (review the HST filing or the Notice of Assessment) :

-

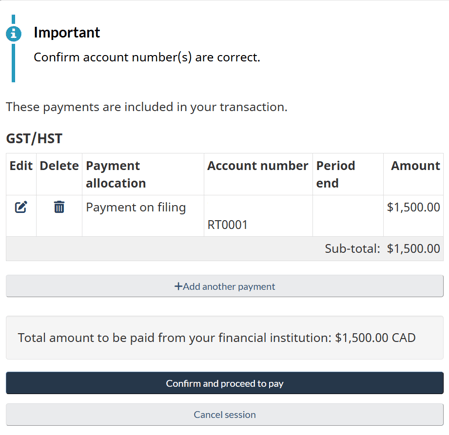

Confirm and submit the payment

Review all details: business number, payment type, amount. Click on Confirm and Proceed To Pay

-

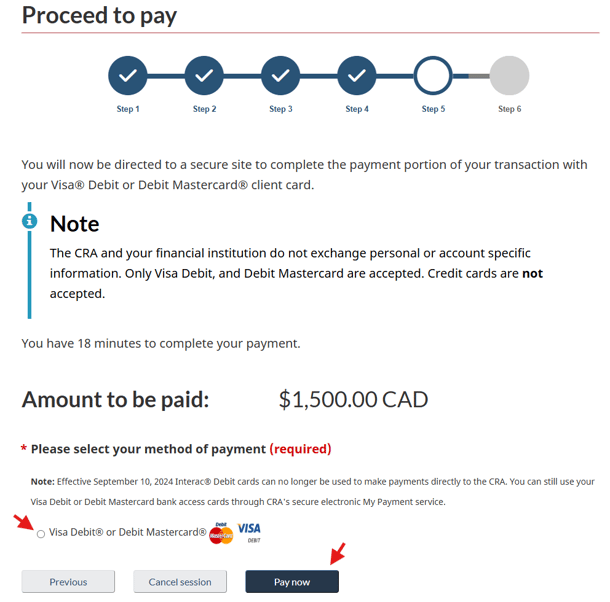

Proceed to Pay

Select Visa Debit or Debit Martercard and click on Pay Now

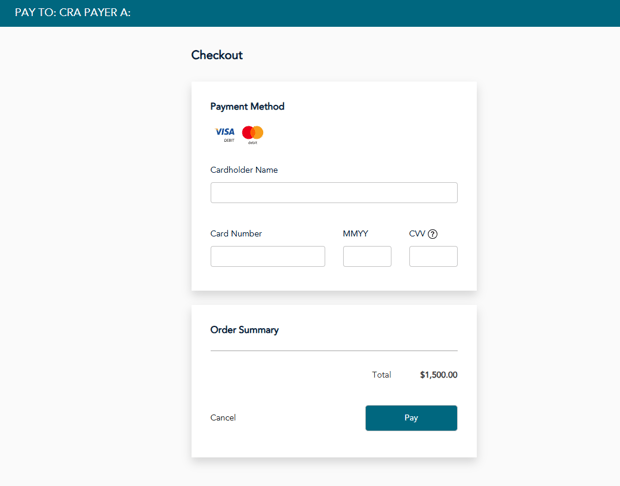

- Enter Card Information and Pay

Put in the Cardholder Name, Card number, Expiration date, CVV and click on Pay

-

Verify the payment is applied

Payment is generally processed the same business day or by the next business day. However, the CRA notes that status may take up to 3 business days to appear in your account.

Log into your business account (like the CRA’s “My Business Account” portal) to ensure the payment has been applied correctly.

Important tips & cautions

-

Timing matters: Submit your payment well before the due date. Even when paying online, delays in processing (weekends, bank cut-offs) may affect same-day credit.

-

Check bank limits & fees: The CRA itself does not charge a fee for My Payment, but your financial institution might. Also check your daily transaction limit on that debit card.

-

Use the correct payee/program type: Entering the wrong program (for example, personal tax instead of GST/HST) or mis-typing the BN can lead to your payment being applied incorrectly or delayed. A blog post warns: “Never use a generic ‘CRA’ payee if specific options exist.”

-

Keep the confirmation: Print or save the payment confirmation screen to your files — this supports your audit trail and can help if there are issues with allocation.

-

Need to schedule ahead? If you want to schedule a payment in advance, note that with online banking or the CRA’s Pre-Authorized Debit (PAD) option you may need to allow at least 5 business days to set it up.

-

If you can’t pay on time: The CRA provides guidance on what to do if you can’t make a payment, including contact options. It’s better to engage early

When My Payment may not be right

-

If your business wants to pay by credit card, My Payment will not work. You’d need a third-party service that accepts credit cards and submits to CRA.

-

If you are making a very large payment (or one outside Canada), a wire transfer or other method might be required.

-

If you’re mailing a cheque or paying in-person, those methods have longer processing time and are less efficient.

Summary

For businesses remitting HST, using the CRA’s My Payment service offers a quick, secure option to pay online with a Canadian-bank debit card. By ensuring you have the correct Business Number, selecting the correct program (GST/HST), submitting before the cut-off, and keeping your confirmation, you can minimise the risk of misallocation or late payments.

-1.png?width=450&height=150&name=Logo-Square%20(500%20x%20200%20px)-1.png)

.png?height=200&name=Black%20White%20and%20Red%20Sleek%20Minimalist%20Photography%20Portfolio%20Presentation%20(3).png)