Paying your payroll source deductions (CPP, EI, and income tax withheld) on time is one of the most...

How to Make a T2 Corporate Tax Payment Using the CRA’s My Payment Service

Corporations in Canada must pay their corporate income tax (T2) by the required deadlines to avoid penalties and interest. One of the fastest and most secure ways to make a T2 payment is through the CRA My Payment service, which allows businesses to pay using a Visa Debit or Debit Mastercard—directly from the CRA’s official platform.

This guide walks you through each step of the process so you can submit your T2 payment accurately and efficiently.

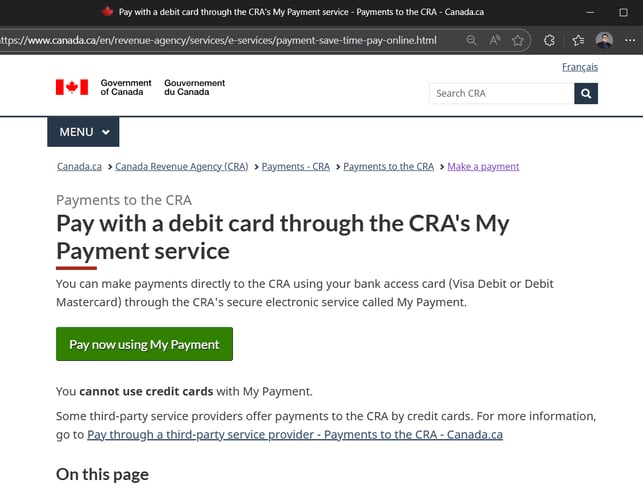

Step 1 — Go to the CRA’s My Payment Page

Start by visiting the CRA’s official payment page:

🔗 https://www.canada.ca/en/revenue-agency/services/e-services/payment-save-time-pay-online.html

Once on the page, click “Pay now using My Payment”.

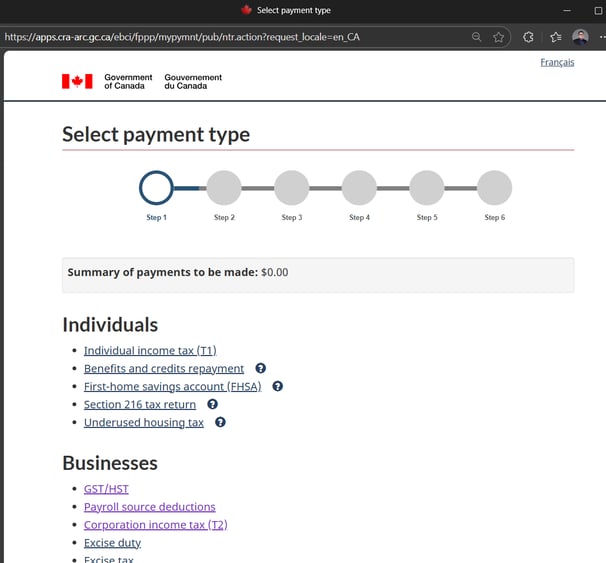

Step 2 — Select Your Payment Type

You will be taken to the “Select payment type” page. Scroll down to the Businesses section and choose:

✔ Corporation income tax (T2)

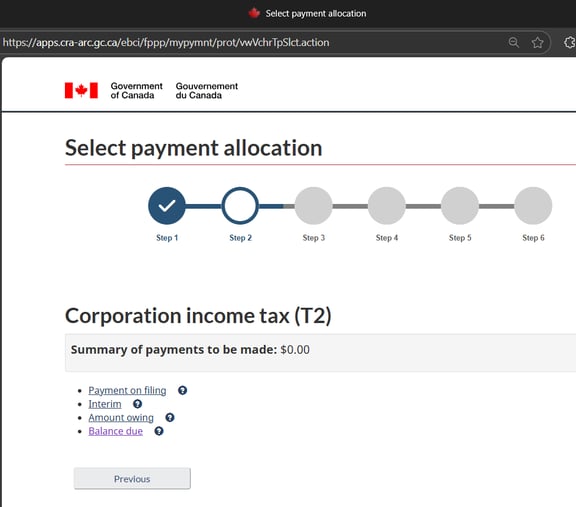

Step 3 — Select Your Payment Allocation

Depending on your corporation’s situation, you will be prompted to select one of the following:

-

Payment on filing

-

Interim

-

Amount owing

-

Balance due

Most corporations making a payment after filing their return will use Payment on filing, but choose the option that applies to your circumstances.

Click Next to continue.

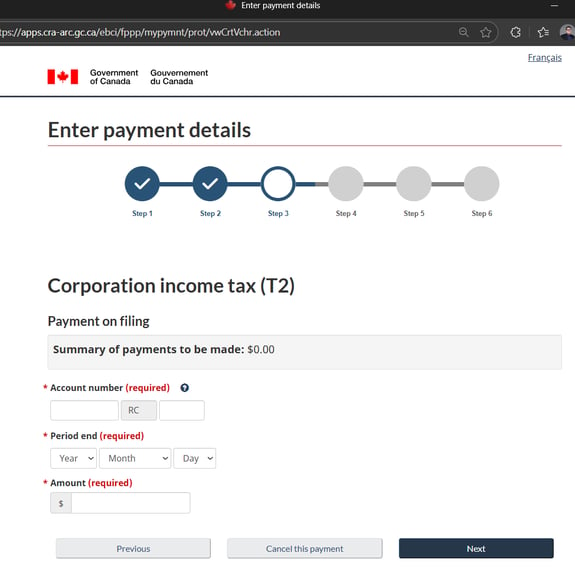

Step 4 — Enter Your Corporate Tax Payment Details

On this page, you’ll enter:

-

RC Account Number (business number + RC program) [Ex: 123456789 RT 0001]

-

Period end (Year, Month, Day)

-

Payment amount

Click Next when finished.

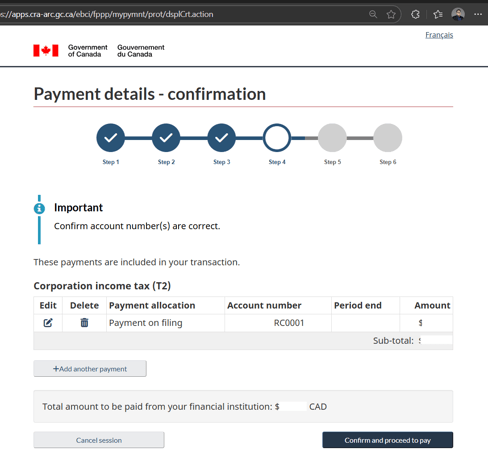

Step 5 — Review and Confirm Your Information

You will now see a summary of your T2 payment. Confirm that all details are accurate:

-

The correct RC account

-

Correct payment allocation

-

Correct period end date

-

Correct amount

If anything needs changes, use the Edit option before moving forward.

Click Confirm and proceed to pay.

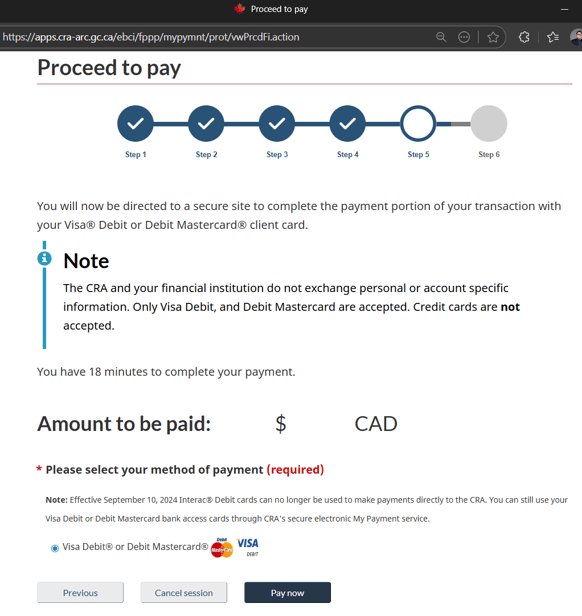

Step 6 — Select Your Payment Method

The CRA My Payment system supports:

✔ Visa Debit

✔ Debit Mastercard

❌ Credit cards are not accepted.

Click Pay now.

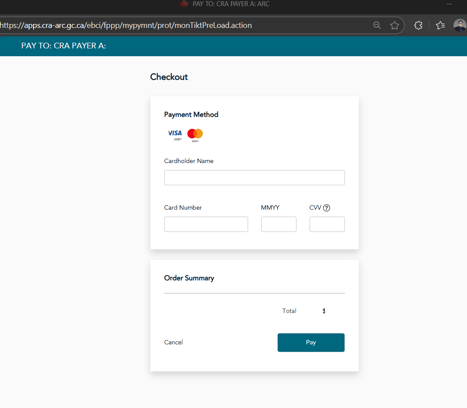

Step 7 — Complete Your Secure Checkout

You will be redirected to a secure payment portal where you will enter:

-

Cardholder name

-

Debit card number

-

Expiry date

-

CVV code

Once you click Pay, your transaction will be processed, and you will receive a confirmation screen.

Step 8 — Save Your Receipt

Always save or print your payment confirmation. This serves as proof of payment and is useful during corporate year-end, audits, or CRA correspondence.

Final Thoughts

Using CRA My Payment is one of the fastest and easiest ways to stay compliant with your corporate tax obligations. Whether you’re making a payment on filing, an interim installment, or paying a balance due, following the steps above ensures your payment is applied correctly and on time.

Need Help With Your Corporate Tax Payments?

At Toro Accounting, we support corporations across Ontario with T2 filings, installment planning, CRA compliance, bookkeeping, and full corporate tax management.

If you’d like help with your return—or want us to handle your CRA payments for you—reach out today and let our team make corporate taxes easy and stress-free.

-1.png?width=450&height=150&name=Logo-Square%20(500%20x%20200%20px)-1.png)