Corporations in Canada must pay their corporate income tax (T2) by the required deadlines to avoid...

How to Make Payroll Source Deduction Payments Using the CRA’s My Payment Service

Paying your payroll source deductions (CPP, EI, and income tax withheld) on time is one of the most important responsibilities for Canadian employers. The Canada Revenue Agency (CRA) offers several payment methods, but one of the fastest and most secure options is My Payment, an online service that lets you pay directly using a Visa Debit or Debit Mastercard.

Below is a step-by-step guide on how to submit a payroll remittance using CRA My Payment.

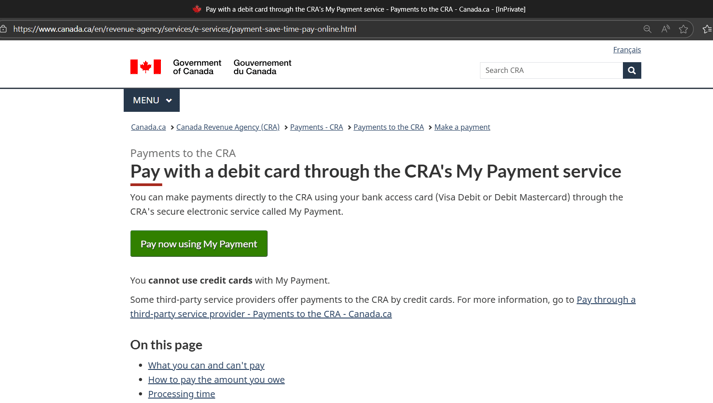

Step 1 — Go to the CRA My Payment Page

Visit the CRA’s official My Payment page on Canada.ca or go to https://www.canada.ca/en/revenue-agency/services/e-services/payment-save-time-pay-online.html

Click the button that says “Pay now using My Payment.”

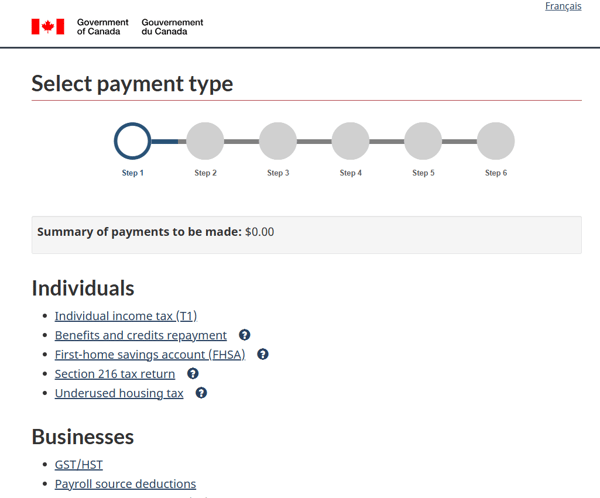

Step 2 — Select Your Payment Type

You will be taken to the “Select payment type” screen.

Scroll down to the Businesses section and choose: ✔ Payroll source deductions

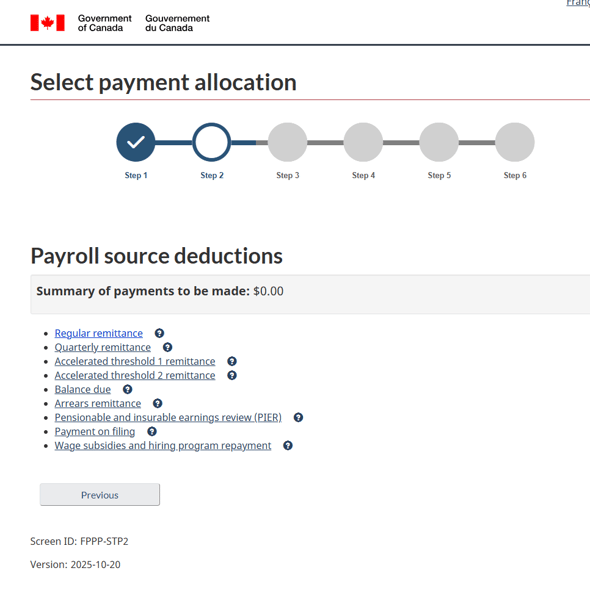

Step 3 — Choose the Type of Payroll Payment

The CRA will ask what type of payroll payment you want to make.

The most common one for employers is: ✔ Regular remittance

Other options may include:

-

Quarterly remittance

-

Accelerated Threshold 1

-

Accelerated Threshold 2

-

Balance due

-

Arrears

-

PIER amount owing

-

Wage subsidy repayments

Select the option that applies to your business, then click Next.

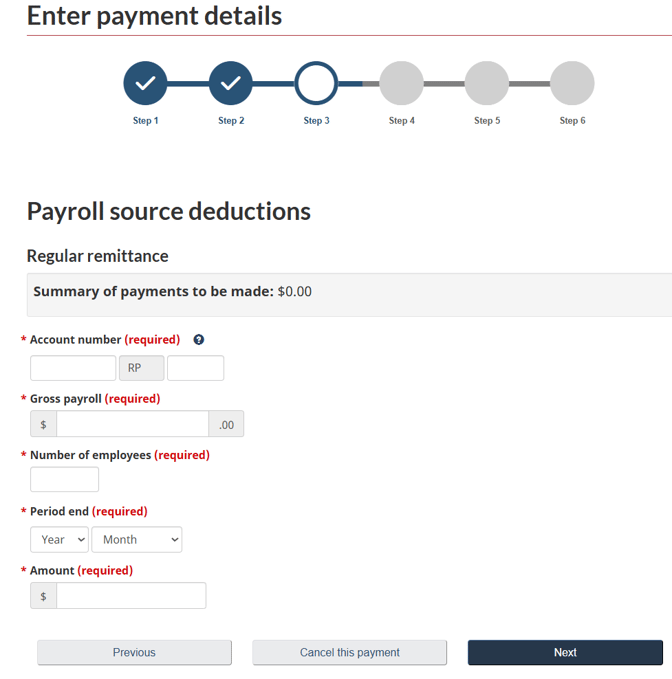

Step 4 — Enter Your Payroll Payment Details

You’ll now be prompted to enter your payroll remittance information:

-

RP Account Number (business number + RP program) [Example: 123456789 RP 0001]

-

Gross payroll for the period: This should be on the PD7A form

-

Number of employees: This should be on the PD7A form

-

Period end (Year & Month): This should be on the PD7A form

-

Amount of the remittance: This should be on the PD7A form

When everything is filled in, click Next.

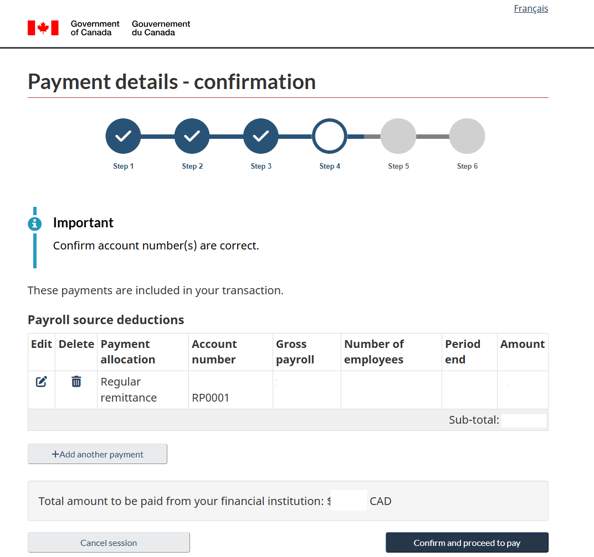

Step 5 — Review and Confirm Your Information

You will see a confirmation page showing the details of your payroll payment.

Carefully verify:

-

Account number (RP account)

-

Payment type

-

Payroll period

-

Remittance amount

If something needs correcting, use the Edit button before proceeding.

Click Confirm and proceed to pay.

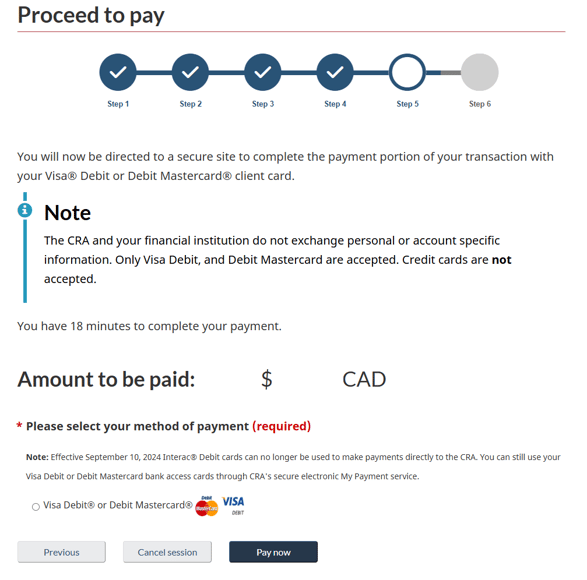

Step 6 — Choose Your Payment Method

My Payment accepts only:

✔ Visa Debit

✔ Debit Mastercard

Credit cards are not accepted for this method.

Click Pay now.

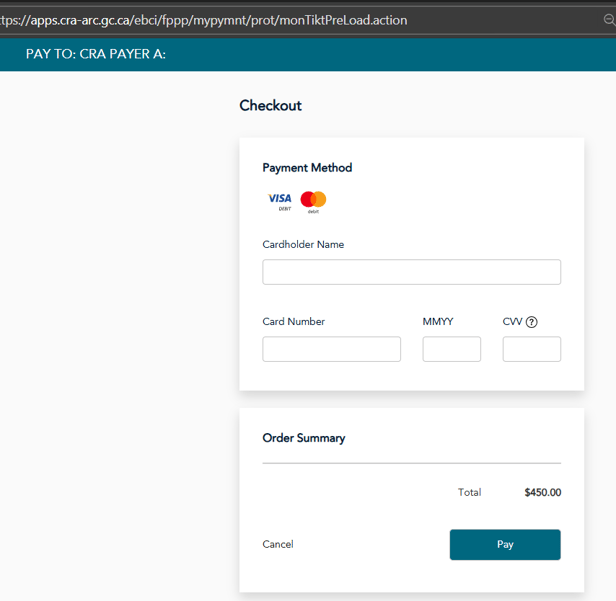

Step 7 — Complete the Secure Checkout

You will be redirected to a secure checkout page from the payment processor.

Enter:

-

Cardholder name

-

Debit card number

-

Expiry date

-

Security code (CVV)

Click Pay to finalize the transaction.

Step 8 — Save Your Receipt

Once your payment is completed, download or print the confirmation page for your records. This is helpful for bookkeeping and for proving payment in case of CRA inquiries.

Final Tips

✔ Submit remittances on time to avoid interest and penalties.

✔ Always double-check your RP account number to ensure the payment is applied correctly.

✔ Keep copies of confirmation receipts in your payroll records.

✔ If your business frequently remits payroll, consider using Pre-Authorized Debit (PAD) or your bank’s online payroll payee setup or use a payroll system like Quickbooks Payroll or ADP.

-1.png?width=450&height=150&name=Logo-Square%20(500%20x%20200%20px)-1.png)