Effective bookkeeping is the backbone of financial success for any small business in Canada....

How to Fill Out the Form RC-151 for the GST and HST Tax Credit If You're New to Canada

If you do not have children and it is your first tax return in Canada, to apply for the GST/HST Credit & Carbon Rebate, you will need to fill out, sign, and send Form RC151, GST/HST Credit and Climate Action Incentive Payment Application for Individuals Who Become Residents of Canada, for the year you became a resident of Canada.

This form must be sent by mail if it is your first tax return.

Use this form only if you do not have children. If you have children under the age of 19, use CRA My Account or Form RC66, Canada Child Benefits Application.

To download Form RC151, download the PDF here.

Utiliza este formulario solo si no tienes hijos. Si tienes hijos menores de 19 años, utiliza CRA My Account o el Formulario RC66, Solicitud de Beneficios para Niños de Canadá.

Para bajar el formulario RC151 descarga aquí el PDF.

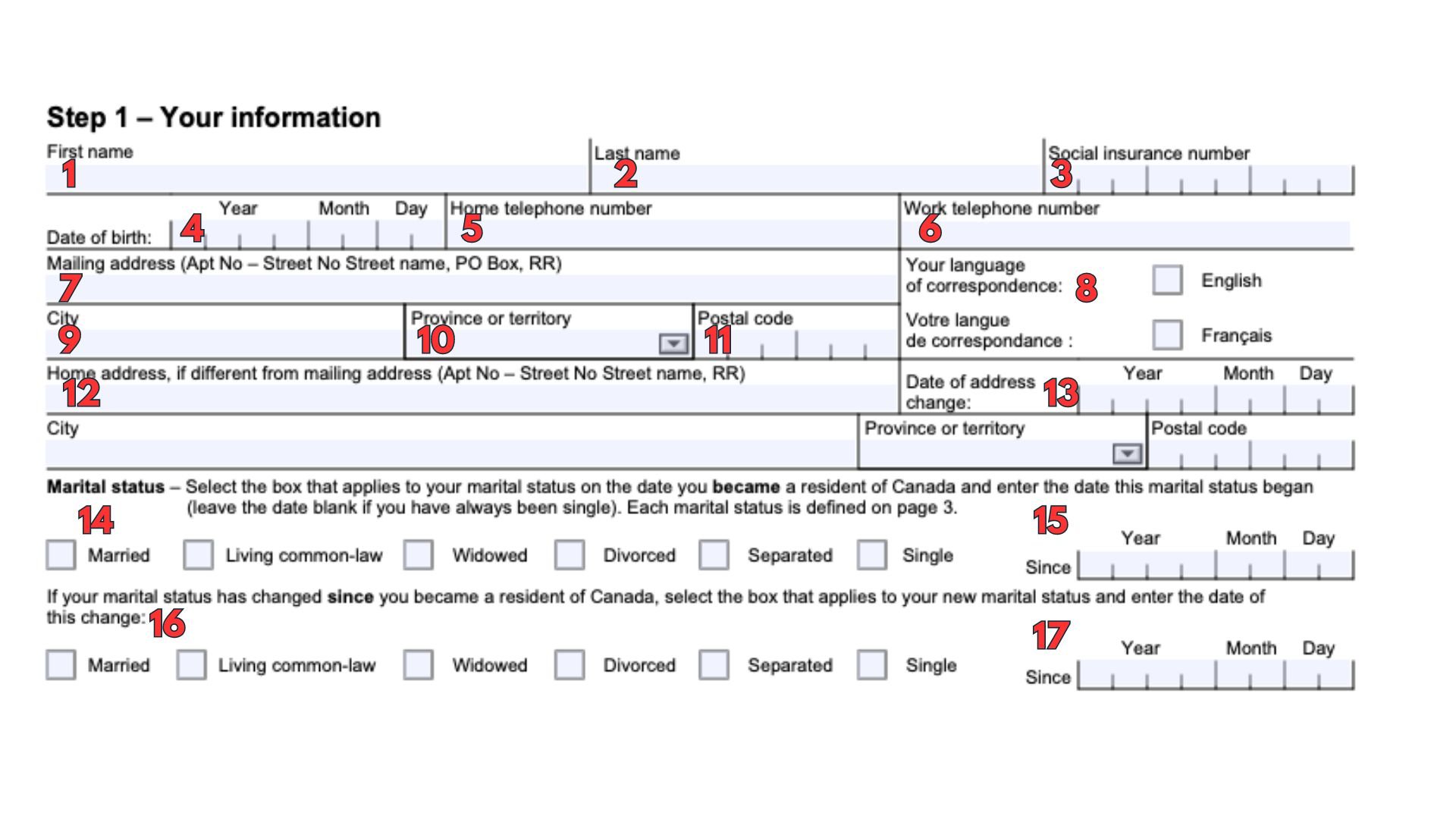

Step 1: Your Information

You need to provide:

-

Tu Nombre

-

Your First Name

- Your Last Name(s)

- Social Insurance Number

- Date of Birth: Year, Month, and Day

- Home/Personal Phone Number

- Work Phone Number

- Mailing Address (Apt No. - Street No. Street Name, PO Box, RR)

- Language of correspondence: English or French

- City

- Province or Territory

- Postal Code

- Home address only if different from your mailing address (in #7)

- Date of address change

- Marital status when you arrived in Canada:

- Married

- Common-law partner

- Widowed

- Divorced

- Separated

- Single

- Since when (marital status in #14)

- If your marital status has changed after you arrived in Canada.

- Since when (marital status in #16)

Step 2: Information about your spouse or common-law partner

-

First Name

-

Last Name(s)

-

Social Insurance Number

-

Date of Birth

-

If your spouse's or common-law partner's address is different from yours, provide it here

Step 3 – Your Residency Status

A - Newcomer to Canada

-

Date when you became a resident of Canada

-

Date when your spouse or common-law partner became a resident of Canada

Who is considered a resident of Canada (for tax purposes)?

You are considered a resident of Canada when you establish sufficient residential ties in the country. These residential ties include:

- A home in Canada.

- A spouse or common-law partner who lives in Canada.

- Dependents who reside in Canada.

If you received a letter from the Canada Revenue Agency (CRA) about your residency status, include a copy with this application.

If you are unsure if you are a resident of Canada, submit Form NR74, Determination of Residency Status (Entering Canada), and include it with this application. The CRA will provide you with an opinion on your residency status.

B - Returning Resident of Canada

- Enter the Canadian province or territory where you resided before severing your residential ties with Canada

- Enter the Canadian province or territory where your spouse or common-law partner resided before severing their residential ties with Canada

- Enter the date you severed your residential ties with Canada (ceased to be a resident)

- Enter the date your spouse or common-law partner severed their residential ties with Canada (ceased to be a resident)

- Enter the date you re-established your residential ties with Canada (became a resident again)

- Enter the date your spouse or common-law partner re-established their residential ties with Canada (became a resident again.

Step 4 – Your Income

Enter your income and that of your spouse or common-law partner (if applicable) from all sources not reported on a Canadian tax return. All amounts must be converted to Canadian dollars using the Bank of Canada exchange rate in effect on the date you received the income. To check exchange rates, visit bankofcanada.ca/rates/exchange.

If you had no income, enter “0.”

A – The year you became a resident of Canada

- Enter the year you became a resident of Canada.

- You: Enter the income earned from January 1 of the year entered above until the date you became a resident.

- Your spouse or common-law partner: Enter the income earned from January 1 of the year entered above until the date they became a resident.

Note: Do not enter your spouse's or common-law partner's income in this section if they did not become a resident of Canada in that year. You will need to report their income for this year on Form CTB9, Income of Non-Resident Spouse or Common-Law Partner, when you file your taxes for the year you became a resident of Canada.

B – One year before you became a resident of Canada

- Enter the year that corresponds to one year before you became a resident of Canada. For example, if you became a resident of Canada in 2023, you would enter "2022".

- You: Enter the income earned one year before you became a resident of Canada.

- Your spouse or common-law partner: Enter the income earned one year before they became a resident of Canada.

C – Two years before you became a resident of Canada

Complete this step only if you became a resident of Canada between January 1 and May 31 of the year you entered section A.

-

Enter the year that corresponds to two years before you became a resident of Canada. For example, if you became a resident of Canada on February 15, 2023, you would enter "2021."

-

You: Enter income earned two years before each of you became a resident of Canada.

-

Your spouse or domestic partner: Enter income earned two years before each of you became a resident of Canada.

Paso 5 – Signature

You certify that the information provided on this form is correct and complete. You understand that making a false statement is a serious crime.

Last step: Send the form in the mail

If your province or territory of residence is

- Alberta, British Columbia, Manitoba, Northwestern Territories, Saskatchewan, or Yukon: Send your form to the following address:

Winnipeg Tax Centre

Post Office Box 14005, Station Main

Winnipeg MB R3C 0E3 - New Brunswick, Newfoundland and Labrador, Nova Scotia, Nunavut, Ontario, or Prince Edward Island: Send your form to the following address:

Sudbury Tax Centre

Post Office Box 20000, Station A

Sudbury ON P3A 5V1 - Quebec: Envía tu formulario a la siguiente dirección:

Jonquière Tax Centre

2251 Boulevard René-Lévesque

Jonquière QC G7S 5J2

Remember that it is important to send the information to the appropriate tax center according to your province or territory of residence.

Unofficially, client's we have had been able to provide the information above by phone or by submitting a document online on MyAccount, however, CRA's official's instructions are to send this form via mail.

If you need a consultation, schedule it here.

-1.png?width=450&height=150&name=Logo-Square%20(500%20x%20200%20px)-1.png)